Portfolio Optimization

Enhancing Alpha in your Portfolio

Optimization Services

Portfolio Optimization with Options

Options Strategies

Enhancing Portfolio Alpha

We can substantially improve the risk/reward profile of your fund’s portfolio with tactical options-based strategies, optimizations and hedging.

Optimization Services

• Portfolio overview

• Case by case position analysis and options recommendation

• Weekly review and optimization based on your macro views

• Full service options-based portfolio optimization based on your underlying trades or market views

Portfolio Optimization with Options

Our seasoned option pros, led by our options guru CIO Jeff Manera, can substantially reduce the “systemic” risk, from exposure to the markets, in your portfolios, while increasing the probability of profitability of net gains and a smoothed equity curve over time.

With Options Strategies we can:

Stock (or index) “repair” strategies to substantially reduce the required retracement of your underlying position to recover from a loss.

Employ high-probability strategies custom structured to safely leverage for your macro views or dynamically adjust to the current market’s evolving volatility.

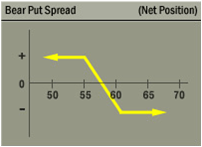

Vertical spreads and iron condor implementation, management and strategic rolls, dynamically adjusting and rolling in response to market dynamics and your investment goals and views.

Options Strategies

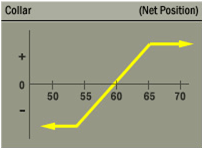

We can employ a powerful arsenal of tactical option strategies to fit any investment scenario, as well as simple long calls and puts (sometime simple is the best strategy). Some of the more common strategies: